The huge rise in the popularity of computer and video games has translated into a corresponding increase in people watching those games played at an elite eSports level. Research by Nielsen finds that 62% of people who personally play a game think it’s important to also watch that game, delivering a synergy between the growth in gaming markets and eSports.

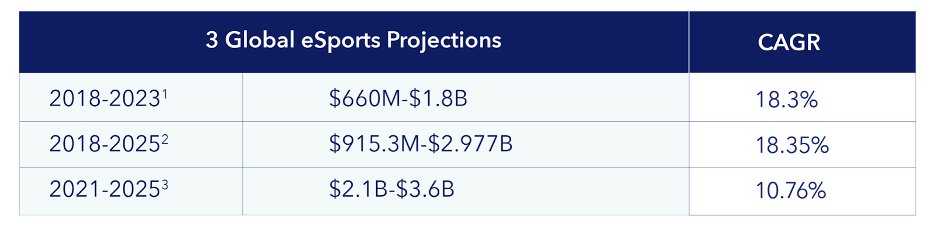

The fact that eSports is becoming so intrinsic to gaming culture is supported by data that shows it considerably outpaces the annual growth in games and console sales. Several researchers have come to similar conclusions about the growth potential of eSports. Juniper Research, for example, predicts viewership will grow to over one billion by 2024, up from 800 million by the end of 2021. This growth is worrying major SVOD providers such as Netflix, whose CEO suggested in a stockholder report that YouTube Gaming and Fortnite were bigger threats to their model than other video streaming services.

It’s not just overall viewership numbers that are growing rapidly. It’s also the time that game viewers dedicate to watching their favorite eSports, especially in comparison to competing options. Deloitte found that in the U.S., a quarter of gamers watch over four hours of content a week. Forbes observed that among younger demographics, particularly 18-25, over 75% watch more eSports than traditional sports. This doesn’t just include the stereotypical Gen Z/Millennial either; 40% of Gen X and 30% of female gamers tune in to watch other people play games every week.

How eSports publishers are adapting

eSports isn’t new, but its recent surge in viewership certainly is. As a result, publishers are still adapting to a dynamic content and interaction environment. The digital and traditional tools used by game producers and distributors to boost the quality and availability of eSports include utilizing advances in production technology, networking algorithms, and the storage and distribution potential of cloud servers. This new popularity has seen them integrate virtual social networks and engagement models to transform popularity into a solid entity and pursue new means of monetization.

The future direction of eSports distribution and how publishers will harness its popularity and transform it into a standard model is uncertain, with a myriad of different approaches and perspectives currently enjoying popularity. Some approaches focus on large, in-person events (following the traditional sports model), while others focus on showing the gamer playing eSports games at home. Another approach to consider is whether global super leagues generate as much engagement as high-quality national championships. Regardless of which mode is eventually followed, it will have a major impact on the distribution, monetization, and protection of eSports content.

Game publishers, who initiated eSports as a way to promote their core products, will influence future consumption models. It’s not as straightforward as it seems, however, as challenges continue to exist, including how to balance games between something that anyone can pick up and play (which delivers sales revenue) versus one that shows off the great skills of professionals (which is monetized through advertising or other non-direct income).

Considering the potential and global mass appeal of eSports games, whichever way publishers decide to go, success and considerable growth is still likely to be the result.

The future of eSports distribution

Up to this point, the eSports distribution scene has been dominated by major players backed by established digital giants, such as Amazon’s Twitch, YouTube Gaming, and Facebook Gaming. These platforms have merged well with the burgeoning eSports field and have helped create easy-to-use hubs for gamer-viewers to locate their favorite games and gamers.

These distribution platforms were among the largest beneficiaries of the stay-at-home directives in place throughout the pandemic, with all of them achieving significant growth. Twitch, which is currently the largest game streaming platform, increased its viewing hours to 3.1 billion in Q1 2020, a 17% rise from the previous quarter.

However, despite the ease of effectively having third parties running their streaming distribution, game publishers also recognize this situation as a lost opportunity to expand their own revenue streams. Rights holders are currently exploring their options, including the potential of leveraging their control over games through IP rights. This would improve their own positioning in terms of content distribution and monetization, and possibly lead them to establish their own direct-to-consumer (D2C) eSports distribution platforms. In a counter-play, the established streaming sites are constantly seeking to improve their own features, especially on the social interaction side, to build strong communities that will make them too big to be pushed out of the scene.

However eSports distribution grows in the future, it will need content protection to mitigate the threat of video and service piracy. To learn more about how the surging success of eSports intensifies the need for robust, affordable content and revenue security, download our whitepaper.